| |

|

|

|

|

|

|

|

|

|

QUESTION 2 |

|

|

|

|

|

|

|

|

|

|

|

PRIMARY (AD VALOREM) PROPERTY TAX

IMPLEMENTATION

--RESOLUTION

NO. 8649 |

|

|

|

|

|

|

|

|

|

|

|

Shall the City of Mesa be authorized to

raise an amount not to exceed Thirty Million Dollars ($30,000,000) by

primary property tax (ad valorem tax)? IF SUCH AMOUNT IS APPROVED BY THE

VOTERS, IT SHALL BE THE BASE FOR DETERMINING LEVY LIMITATIONS FOR THE CITY

FOR SUBSEQUENT FISCAL YEARS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regressive Tax or Not?

Both the Property Tax and the Sales Tax

have been labeled "Regressive". What's the deal with that?

|

|

|

Income

|

Fixed |

Regressive |

Proportional |

Progressive |

|

Tax |

Rate

|

Tax |

Rate |

Tax |

Rate |

Tax |

Rate |

| Jones |

$10,000 |

$500 |

5% |

$500 |

5% |

$500 |

5% |

$500 |

5% |

| Smith |

$80,000 |

$500 |

0.625% |

$1,600 |

2% |

$4,000 |

5% |

$20,000 |

25% |

| Brown |

$500,000 |

$500 |

0.1% |

$5,000 |

1% |

$25,000 |

5% |

$250,000 |

50% |

|

If you study the table you'll see that a Regressive tax is such

that you pay a smaller percentage of your income as your income

rises. Conversely, Progressive taxes have you paying a higher

percentage of your income as your income rises.

An example of a Progressive Tax, that everyone is

familiar with is Income Tax. The higher your income, the

higher the Tax Rate. Social Security FICA Taxes, however, are Regressive.

You pay a Flat rate of 6.2% for income up to $90,000, but nothing after

that. That mean for those earning over $90,000 the withholding rate

is less than 6.2%.

That said, Sales Tax on food is somewhat regressive because the

proportion of an individual's budget spent on food declines as income

rises. (Mesa currently does not have a Sales Tax on

food.)

Property Taxes can be considered

either "Regressive" or "Progressive".

People with higher incomes tend to buy more expensive homes and pay higher

Property Taxes (Progressive); yet those with lower income

pay a greater portion of their budget for Property Taxes on

their more modest homes (Regressive).

The confusion comes about because these are not the true

definitions of the terms "Regressive" and "Progressive".

Sales Taxes are Transaction Taxes which are incurred

only at the time of a transaction. Property Taxes are Ad

Valorem taxes incurred through ownership of an asset.

(Ad Valorem is Latin for "according to value")

Both are actually Proportional

Taxes (Flat Rate) on the things that they tax. Either 8% Sales

Tax or $1 per $1000 Property Tax are Flat Rates.

They only become "Regressive" when you consider them in

the context of the person paying them. That's beyond the original

definition, but both the "Yes" and the "No" crowd

stretch the definitions to make their points. So

calling Sales Taxes or Property Taxes "Regressive"

is mostly a moot point. Think the poor are being fleeced? Try

cashing a check at PayDay Loans. $50 on $500 for a two week loan is

hella-regressive! |

|

|

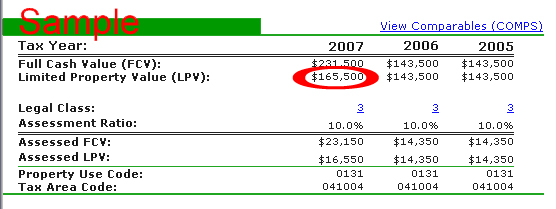

YesForMesa 2007 Example

Numerous references point you to the YesForMesa

website to get a handle on what your likely Property Taxes will

be. In fact, one Arizona Republic writer claims that

this will tell you "EXACTLY" what your taxes will

be. That couldn't be further from the truth. At least I hope

so.

Here's a snapshot of what their site says: |

|

|

|

|

|

The

total amount that the city can collect from a property tax would

be capped at $30 million a year with an available 2% per year

increase for inflation. Any other increase would require a vote of

the people. Since the limited property values went up for

2007, the assessment ratio would go down. Also, remember

that the Limited Property Value (LPV) is capped in how much it can

increase in a single year.

It is estimated that the new

assessment rate will be close to $0.95 per $1000 in limited

property value in 2007 which is down from $1.00 per $1000 in 2006.

Use the number circled in

the sample below to calculate the 2007 estimated tax.

In the sample, this home

would pay approximately $143.50 in a property tax in 2006 and

$157.23 in a property tax in 2007. A difference of $13.00 or

about a dollar a month.

|

|

|

|

|

Some Observations

First of all, should the Property Tax

pass, using YesForMesa's own numbers, the TAX INCREASE in

2007 from 2006 is $157.23 - $143.50. That's a difference of

$13.73. That's a bit more than the "$13.00" they

quote. That's really nearly $14. It's pretty sloppy math.

More importantly, $13.73 represents an

INCREASE of nearly 9.6% over the $143.50 City of Mesa Property Taxes to be

paid in 2006. So that's a 10% increase; and this just because your Property

Valuation went up? That's really sloppy

math.

In theory as Property Valuations go

up across-the-board, the Tax Rate should decline

accordingly. For the YesForMesa example, that means that in 2007,

the rate should have declined to about $0.87 / $1000. So either the

$0.95 / $1000 they quote is way off, or they know something that you don't

By the way, that example is assuming that

the City Council doesn't exercise it's option to apply a yearly increase

on the $30 Million Property Tax (which is limited to 2% per year).

|

|

|

Secondary Property Tax

Secondary Property Taxes have only

been mentioned in passing. Despite some questions to the city, to

clarify how they might be implemented, I'm not satisfied with the responses.

Recently the Arizona Republic had this to say:

|

|

|

|

Regardless of the election results, the

City Council has the option of instituting a Secondary Property Tax

at its

discretion to pay bond debt, but has said it would only use it for future

bond elections.

Arizona

Republic |

|

|

|

|

My Questions

- Do you trust the City Council to keep it's word, and

only apply a Secondary Property Tax to future

bond elections?

- It's unclear, but this implies that at it's

discretion, the City Council could retroactively decide to pay down

existing bond debts by implementing a Secondary Property Tax, WITHOUT

Voter Approval.

- Would you have approved of past Bond Measures, had

you known that the City Council would implement a Secondary

Property Tax?

- Even if you do have trust in the current

City Council to keep it's word, these are only their

promises. Nothing here is legally binding on any future

City Council.

- Would you vote now, to implement the Primary

Property Tax (on the ballot), if you knew that just around the

corner, was a Secondary Property Tax in the offing?

|

|

|